What happened to all the doomsday predictions back in April?

As we roll into July of 2025, I can’t help but reminisce of all the doomsday messaging that was proliferated online regarding tariffs and the impending doom of the US economy.

Everything is going to double in price, they said! Trump doesn’t know what he is doing, they said! Our economy is going to sink into depression, they said! All the experts laid out a hundred different scenarios and theories about what would happen and how it all would end. In a previous blog post I wrote in April, I ended the article by saying that I would continue to ‘invest in America’ and keep sinking more of my investment dollars into solid American companies. Just 3 short months later, let’s see if that advice turned out to be good advice or misguided?

The US Stock Market appears to have reached new highs. The S&P 500 closed out June at 6,204. That’s a good thing!

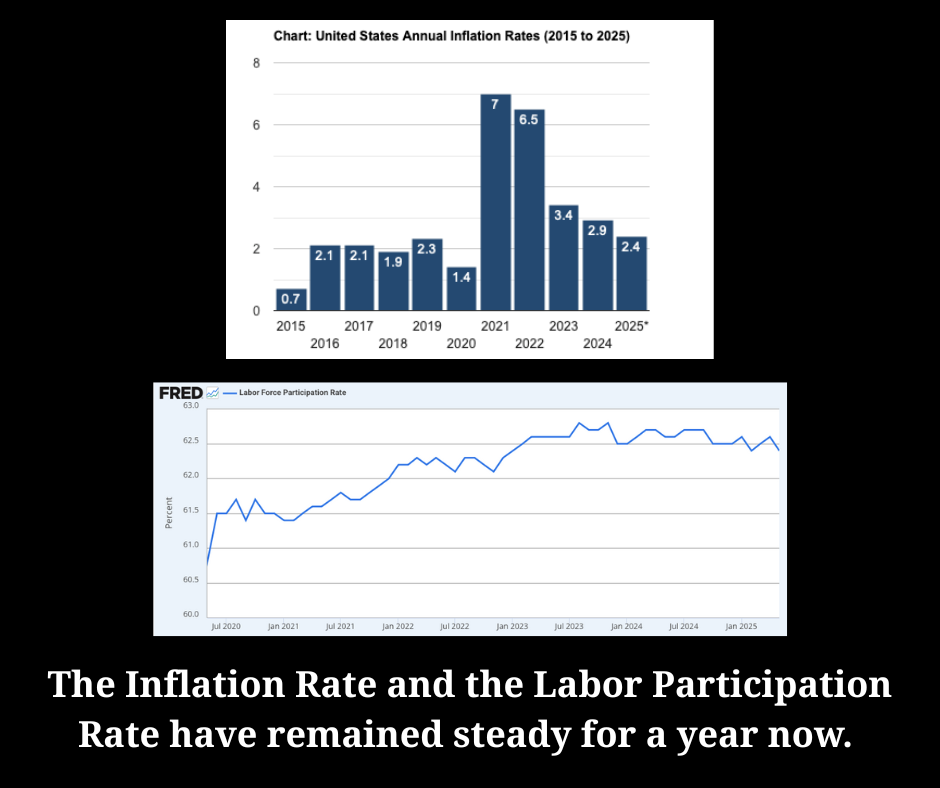

Inflation has held steady for almost a year now. Steady inflation that is in line with expectations and historical norms is a very desirable thing! The labor participation rate has also held steady for a couple of years now. The US economic engine is running normally without any major hiccups or reasons to start a panic. Yet, another good thing!

And finally, a very good measure of the health of the US economy is the delinquency rate of business, as reported to St. Louis Federal Reserve. As you can see in the chart below, delinquency has remained at historic lows since late 2018 and shows no real signs of a spike. Also, a good thing!

If we stop and take a look at many of the meaningful metrics that measure the health of the US economy, things appear to pretty much be on cruise control. Minor speed bumps in employment and the stock market will happen and are a normal part of the economy, but for now, things appear to be business as usual.

Now, if we could only do something about interest rates…………………………….but that is a topic for another day